Numerical treatment of stochastic control problems

by Fourier-cosine series expansions

The dike height problem

Marjon Ruijter

Supervisor: Kees Oosterlee

Site of the project:

Delft University of Technology

start of the project:

November 2009

The Master project has been finished in September 2010

by the completion of the

Masters Thesis

and a final presentation

has been given.

For working address etc. we refer to our

alumnipage.

Summary of the master project:

In financial markets traders deal in stocks and options, such as the well-known call and put options. An

option is a contract between a buyer and a seller that gives the buyer the right to buy or sell a particular stock under prescribed conditions. In this turbulent trading world, questions about a `fair' option

price and the hedging of risks arise. In the recent decades financial mathematics has developed fast to

contribute to this theory and to improve the pricing methods.

In economical, but also in personal or societal contexts, one may face options in the sense of real `choices'.

For example, should one build a new factory now or later. These options are called real options and can

be related to the financial options.

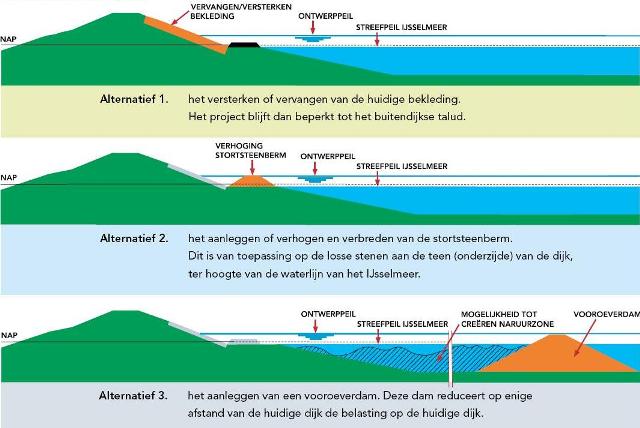

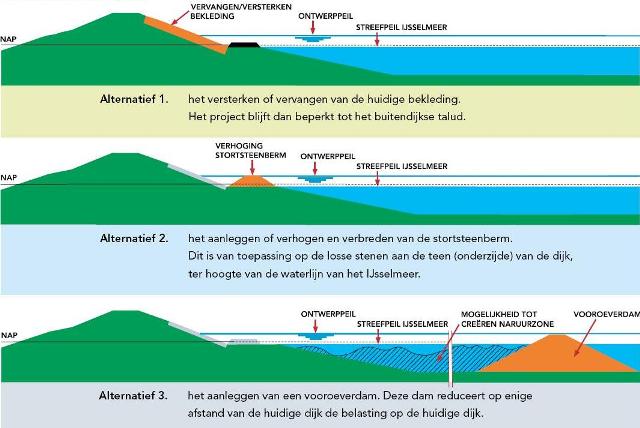

Alternatives for a stronger dike

Dike height increase

Contact information:

Kees

Vuik

Back to the

home page

or the

Master students page of Kees Vuik

![]()

![]()